The DC region ranks ninth among the 50 largest metro areas in the nation for most expensive home prices, according to Zillow, and year-end data from the Northern Virginia Association of Realtors shows the average home price in NoVA specifically was $614,000 in 2019. But is homeownership here really an impossible dream? The good news: It’s not. You can afford to live here, if you know where to look. As the spring real estate market kicks off (Hello, Sundays spent at open houses!), we asked experienced realtors to fill us in on house hunting in this competitive market.

By Katie Bianco

When Lauyren Haight and her husband decided it was time to start a family, the couple, who were living in an apartment in Pentagon City at the time, first started looking at townhomes near where they were already living.

With a budget of about $500,000, they found what most house hunters with a relatively low budget in Arlington find.

“Every place we looked at in Arlington was out of our budget. Even the townhouses,” says Haight, who works for the federal government as an investigator. “If we wanted to live in Arlington, [the homes in our budget were] in awful condition, and then there would be the extra finances [of renovating it]. I didn’t have the bandwidth for the sweat equity. We knew we wanted to start a family soon. I didn’t want to live in a constant project.”

So, the couple expanded their search outside of Arlington. “We started to casually look at Falls Church … and just kept inching farther and farther away from the Orange Line. We were only looking at townhouses.”

They got into a bidding war for a townhouse in Vienna and lost. “That was really heartbreaking for me,” she says. “I hadn’t experienced that before. I really thought that was the house for us.”

As they moved their search out even farther, they eventually landed in Fairfax City in a 2,000-square-foot single-family home.

They were competing with two other offers, but ultimately won out and closed at $549,000. (Haight says without an HOA fee and the lower taxes of Fairfax City, she was able to increase her budget from the original $500,000.)

To homebuyers in other parts of the country, over half a million dollars for a house may sound exorbitant, but here in Northern Virginia, where the average sale price was just over $614,000 in 2019 (up from $590,000 in 2018), according to data from the Northern Virginia Association of Realtors, that’s the reality of the housing market.

“If you are a first-time homebuyer, these prices are pretty expensive,” says Jeff Tucker, an economist with Zillow. If you look at “Fairfax, Arlington, Alexandria, Loudoun County, Prince William, certainly among those counties, these are mostly more expensive than the Metro area as a whole. These are all places that are pulling up the average for the DC Metro area,” he says.

“And some of those NoVA counties have hit an all-time high for home prices,” Tucker continues. “The median home price in Fairfax is $576,000 … It’s more than surpassed its pre-recession peak. When you have a national reputation for excellent schools and high quality of life [it helps drive prices up]. Similarly, Arlington County is at an all-time high. Its median price there just got over $700,000, so that’s very difficult to obtain for a first-time homebuyer.”

A Different Kind of Buyer

It used to be, home buying tended to happen on a typical timeline. Get married, move to a single-family home with a white picket fence and raise a family. Then, when the kids move out, perhaps downsize to somewhere with less yardwork. But now, in an era when fewer people are getting married (70% of the adult population in the DC region is single, according to U.S. Census data, which is 20% higher than any other region in the country) and fewer people are having babies; many people of homebuying age are grappling with crippling student debt; and Generation X and baby boomers are welcoming their adult children—who often can’t balance student loan debt and a mortgage—back home, the profile of the “typical” first-time homebuyer has changed.

“The first-time homebuyer is very different today than what it was 20 years ago,” says Debbie Baxter, principal broker and co-owner of Clifton-based Coppermine Realty. “Twenty years ago, 69% of the first-time homebuyer population was married with one child. Now it’s roughly about 32%, so it fell by half.”

Baxter, who has been working in the local real estate market for 25 years, says she also sees student loan debt playing a major role in how and when her clients both buy and sell homes. Millennials “are extremely saddled with student debt. So, you’re actually seeing Generation X buy a slightly bigger house with an in-law suite to live with their own grown children. That’s becoming more popular.”

For those first-time homebuyers who are able to take the leap, they’re budgets don’t necessarily mirror their salaries. While Northern Virginia has some of the highest salaries in the nation (Loudoun, Arlington and Fairfax counties all rank in the top 10 of highest median salaries in the nation, according to U.S. Census data), student loans bring budgets down.

Says Baxter: “I have a client who is an engineer. He makes a decent salary of $80,000, but a $600,000 mortgage [for a single-family home] isn’t something he’d ever take on. So, he’s looking at condos in Fairfax for about $300,000. That’s the sweet spot.”

For those looking at single-family homes like Haight’s family, that budget may go up a bit, but the demand for homes well under a million dollars is high, says Christine Richardson, a realtor with Weichert, and the 2019 president of Northern Virginia Association of Realtors.

Thirty-nine percent of buyers right now are millennials (those born between 1981 and 1996, which means they’re between 22 and 37 years old now), notes Richardson, who has been a realtor in NoVA for 31 years. And, unlike generations before them, “they’re not looking for McMansions. They’re looking for a first-time buyer type of a house and so the demand in that lower price range is extremely high. They’re looking to spend between $200,000 and $500,000 for the most part, so that’s why the market in that price range is extremely hot.”

That was the case for Alicia Stump, 34, a millennial who, after paying off about $20,000 in student loans (a relatively low amount compared to many of her peers) about six years ago, decided it was time to make the leap to homeownership. “My first goal upon getting a job was to pay off my student loans,” says Stump, a marketing manager who lives in Arlington.

Once she was debt-free (she also paid off her car loan before starting her home search), she looked for a condo within her max budget of $400,000 in Arlington and Falls Church, ultimately moving into a two-bedroom, one-bathroom condo in Arlington’s Shirlington neighborhood with a price tag of $359,000. “I’m single, so I didn’t want to move out to the suburbs,” she says. “I love Arlington for the restaurants and the walkability. There’s so much to do and so much accessibility.”

Stump says even in that price range, she got caught up in the real estate frenzy. With low inventory across the board, homebuyers find a competitive market with multiple bids not uncommon. Stump, for example, lost out on four other condos in multiple-bid situations before finding her home.

But it’s all relative, says Stump, who is originally from New Hampshire. She has friends who recently bought in her home state and, she says, “My condo costs more than their house. But my thought is, you want to live where you’re going to be happy. There’s a reason it’s so expensive here: because people love living in Arlington.”

Moving for More

But what about people who have that same, under-half-a-million budget, but need more space?

For many, like Haight, it meant moving outside the Beltway to get more for the money.

“I have a client who is an electrician,” says Baxter. He makes $100,000, but given his car payment and his student loans, he can’t go over $300,000. So that’s a condo in Fairfax, but he doesn’t want a condo. He has a dog, so he wants something with a yard. That puts him in a townhouse, and that brings us out here to Prince William County.”

Reggie Copeland, owner and principal broker with C.R. Copeland Real Estate, who has been working in the real estate market for 23 years, says he’s also guiding his clients in the market for more than a condo out farther.

“I had a buyer who wanted to stay in the Fairfax area and we looked all over Fairfax,” says Copeland. “One Saturday, I introduced them to the Gainesville area [in Prince William County]. They immediately said, ‘It’s too far.’ And I said, ‘Well, let’s just go look,’ and we looked in the Braemar area. A home in Fairfax at about 3,000 square feet or less was $650,000. We got a very similar house in Braemar for $575,000. They were very hesitant at first because of the location, but when they saw what they could get and it was roughly $75,000 less, they said, ‘It’s a no-brainer.’ So, they moved from Fairfax to Gainesville.”

One reason buyers are willing to look farther out, say realtors, is a function of the modern-day work culture. Telecommuting has become an option for more and more workers, so being within an easy driving distance of your office or near public transportation isn’t always a requirement.

“I have a client right now,” says Ritu Desai, an associate broker with Samson Properties, who has been in the market for 16 years and primarily works with clients in Loudoun and Fairfax counties, “who works in Bethesda and she telecommutes three times a week. They’re willing to buy in eastern Loudoun because that money can buy a newer home, with a little bit more square footage. They’re planning to start a family soon and they want to be in the Ashburn, Leesburg or Sterling school district. They’d rather commute those two or three days. Telecommuting has allowed people to look a little farther away rather than just inside the Beltway.”

Plus, says Desai, the nightlife options have grown in recent years, meaning it’s not just families looking farther out to get more for their money.

“There are so many suburban options around here with the bar scene that it gives [millennials] other options,” she says. “There are people living in these areas now that it doesn’t just feel like it’s older people living in the suburbs with kids and families. Builders have created communities that offer far more options.”

The Amazon Effect

It’s impossible to examine the local real estate market without addressing the so-called “Amazon Effect.” When the multibillion-dollar corporation announced in fall 2018 that it would locate its second headquarters in Arlington and Alexandria, it had an immediate effect on an already hot market—and will continue to, says Chris Finnegan, a spokesman for Bright MLS, the Mid-Atlantic’s leading multiple listing service, serving more than 95,000 realtors across six states and DC.

“I do a decent amount of traveling [on behalf of Bright MLS] and you would be shocked that all anybody wants to talk about is Northern Virginia and Amazon,” says Finnegan. “The whole idea that people are talking about Northern Virginia, that’s not just a Mid-Atlantic thing, that’s a national dialogue and everybody is watching to see how things develop in our area.”

After the headquarters announcement, prices went up in the immediate vicinity and it wasn’t—and still isn’t—uncommon for sellers to entertain five, six, seven bids for one home.

But it’s also had a domino effect on neighborhoods farther out.

“Initially, we didn’t see an impact,” says Desai, who mainly sells in Fairfax and Loudoun. “But now we do. The reason is because of the affordability. People are being outpaced by the Arlington/Vienna/Oakton/McLean market, so they are looking at the next suburbs where they have a good school district.”

The other impact? Over-inflated prices.

“With the talk of Amazon coming, there are a lot of sellers who have placed a false value on their property,” says Copeland. “They’re putting their house on the market and it’s grossly overpriced and it’s either going to sit on the market or, if someone falls in love with it and makes an offer, it won’t appraise and it ends up going back on the market.”

The buzz about Amazon has also contributed to an already-tight inventory, says Richardson. “A lot of sellers are choosing not to put their house on the market since the Amazon announcement,” she explains. “Because the perception is, ‘Let me wait until Amazon gets into full bloom here and I can hopefully get more for it.’”

Keep Calm

As Amazon continues to make news in the region, pricing will likely remain at frenzied levels, says Finnegan.

“In 2020, I think every time there is the announcement of a new Amazon building going up or there’s some new milestone that is announced in conjunction with HQ2—and you’re going to have that every few months—that reignites the hype for Northern Virginia and the Amazon effect,” he says. “But, on the bright side, a lot of people are also going to be learning, ‘I’ve got a budget and I’ve got a certain amount of property that I can afford.

Where can I get a value in terms of location along with the price that I’m looking to pay?’ Arlington is going bananas [with home prices], but if you go out a little farther, there are deals to be had that aren’t that far away. Look at Loudoun County, look at Prince William County. Those are areas that aren’t that far away, but you can do nicely [within a budget] … If you’re looking to pay a little less or you’re looking for a little more land, there are options as you head out a little bit past Falls Church and get into those areas.”

Despite the indisputable fact that NoVA’s market is a competitive one—near Amazon and well beyond—homebuyers are still taking the leap.

“I think the best advice that was given to me was there are three things to look for when house hunting,” says Haight. “Location, price and condition. You can only have two in Northern Virginia. We ended up forgoing location so we could have a lower price and good condition.”

And staying on budget is what realtors are there to help with, says Desai. “You’ve got to be realistic,” she advises, noting she reminds clients of the financial crash of 2009 as one reason to not get caught up in a frenzied market. “I’ve had buyers who started at $500,000 and now they want to be at $600,000 because they get frustrated they’re not finding anything at $500,000, but they start pushing their numbers and I’m the one who’s saying, ‘Be realistic.’ … A lot of them get carried away with the anxiety that they’re not going to find their next home … So as a realtor, you’ve got to make sure they stay within their budget. It’s all about educating your buyers.”

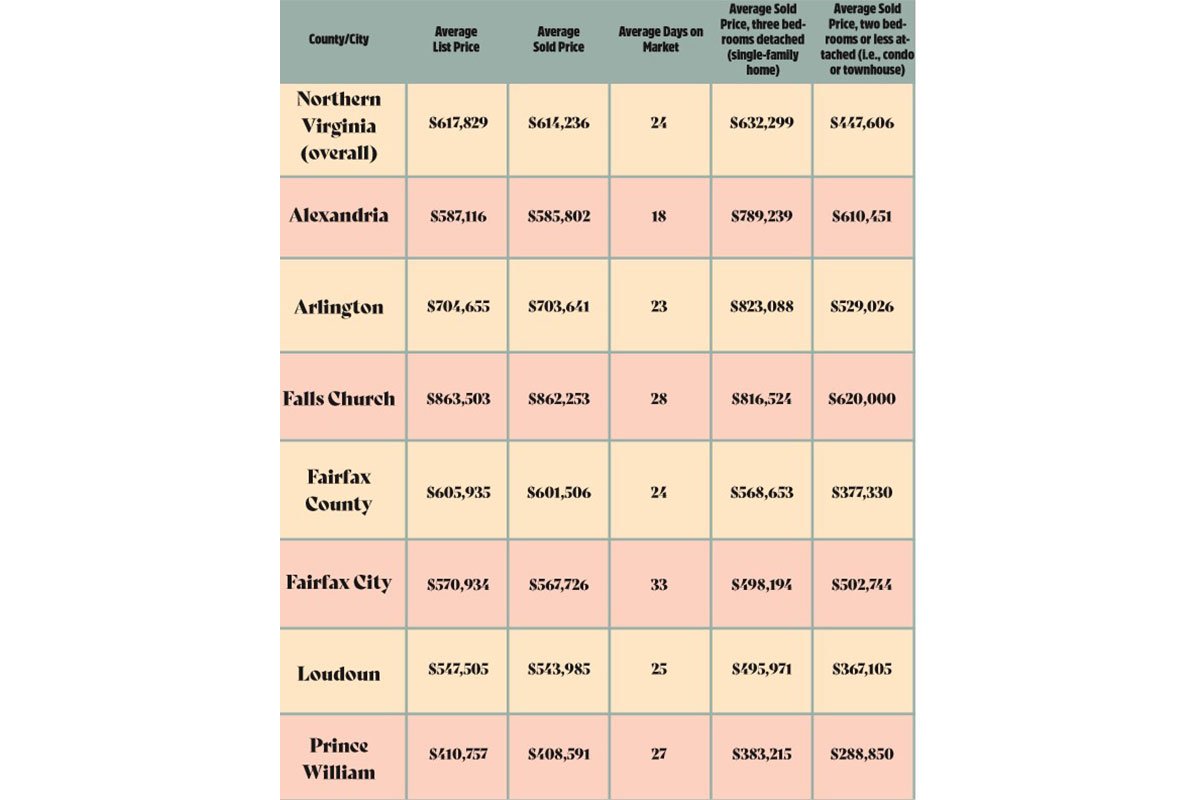

By the Numbers

Northern Virginia is vast and your budget will likely get you more bang for your buck in different areas. Northern Virginia Association of Realtors tracks the numbers across the region. See what the market looked like in 2019 where you live:

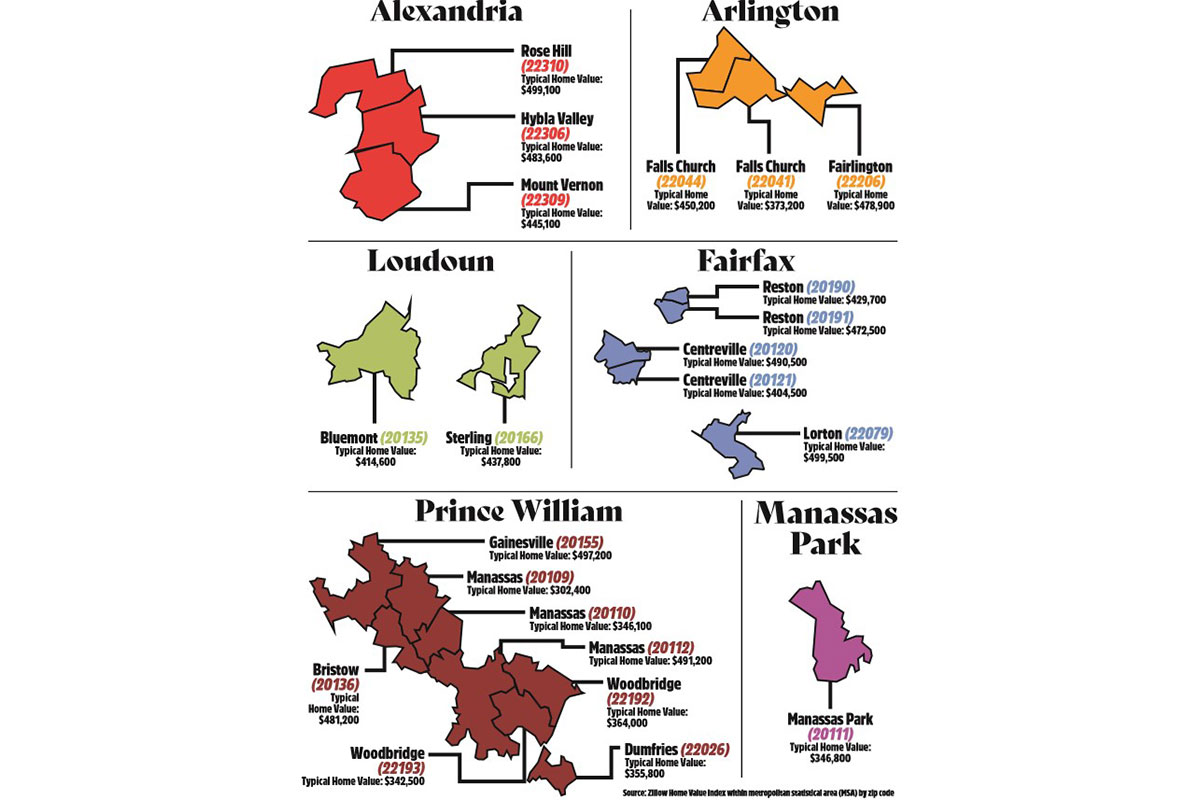

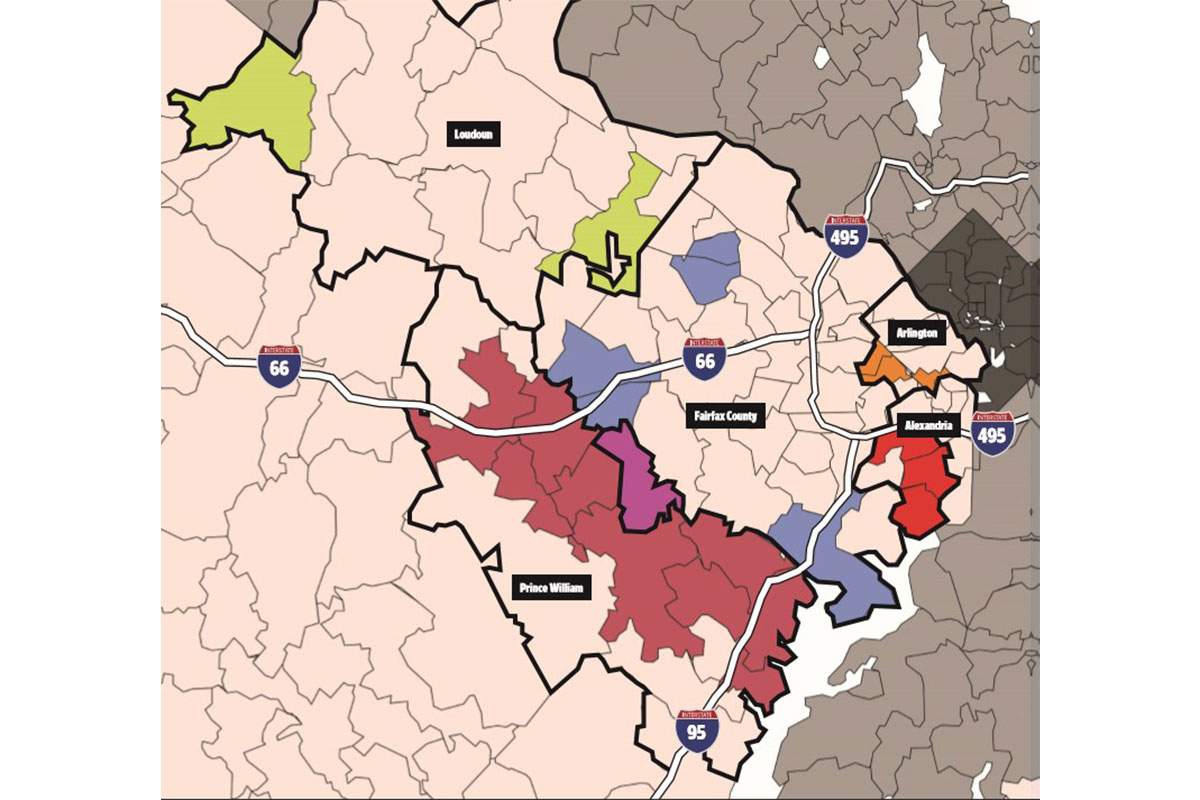

Heat Map

According to Christine Richardson, the 2019 president of NVAR, the average first-time homebuyer has a budget between $200,000 and $500,000. We asked the number crunchers at Zillow to help us find the zip codes in NoVA where you can still buy a home for under half a million. Here’s a sampling of some zip codes to check out.

The following home value numbers were compiled by Zillow. Researchers for the national real estate company measure a number of indicators to determine an area’s typical home value.

The real estate conundrum – buy new, remodel or tear down and rebuild?

When Spencer Newman and his wife decided it was time for a new home, they started looking at houses in their Falls Church neighborhood, but quickly realized they still loved their current home.

“What we saw in our price range in Falls Church were houses that were built recently, with open floor plans and modern appliances,” he says. “The exteriors of those houses stood out and were all modern. But otherwise, they all sort of looked similar [inside].”

So, instead of searching high and low for a house with character, the couple decided to remake their house exactly to their specifications.

“The house was a 1940s style Cape Cod,” Newman says. “But it had only three bedrooms, and the master bedroom was built by the previous owner and it wasn’t great.”

They thought about remodeling, but—after some issues with the roof—they decided to tear down and start fresh, nearly doubling the footprint from 2,200 square feet to 4,200 square feet.

The Newmans’ tear-down is reflective of a growing trend across Northern Virginia. As homeowners find themselves up against tight inventory and multiple bids on homes on the market, some are instead opting to stay put and invest the money into upgrading their home.

Economic developers agree that there are not enough single-family homes and multi-tenant condos in most areas of Northern Virginia to accommodate the growing population of the area. And as current residents see that housing values will likely rise—especially in areas like Arlington and Alexandria as a result of Amazon’s headquarters—some are upgrading where they already have roots.

Tim Winter, founder, CEO and owner of Paradigm Building Group in Falls Church, builds new houses and specializes in tear downs. He says he is seeing a lot of tear-down rebuilds in neighborhoods like Arlington, McClean, Falls Church and Vienna. “It’s happening in the desired neighborhoods inside the Beltway where people want to be,” Winter says. “But they are dealing with the 1940s to 1950s housing stock that either doesn’t meet today’s buyers’ lifestyle, or the home is in shambles because it has issues with ceiling height, or there is water in the basement.”

Winter says that the typical ramblers (meaning long profile, one-story homes popular from the 1940s to the 1970s), don’t give a homeowner the square footage that the typical buyer is looking for today. “They want open floor plans, bigger suites and closets, and there are only two ways to get that—expand the footprint out, which is restricted by the generally small-sized lots, or expand up.”

While it can be more expensive to totally tear down a house and rebuild than simply remodel, a tear-down gives homeowners exactly what they want.

“You can get all brand-new basement walls, brand-new windows and doors,” Winter says. “You can get that with a remodel too, but there are still old components you have to deal with, like plumbing and wiring.”

Part of the desire for a complete rebuild is based on home styles from a few decades ago. In the 1980s, the design trend was for houses to have defined spaces. “Then housing styles in the early 2000s created this open design concept,” Winter says. “The only way to get that concept and enjoy that lifestyle is do a major addition or renovation, or do a total tear-down.”

For the Newmans—who noted they wanted to stay near the schools and parks in their existing neighborhood—the difference in cost was $50,000 ($150,000 for the remodel, $200,000 for a tear-down), but it gave them the opportunity to dig out a functioning finished basement and make it their own—something that many NoVA residents are capitalizing on as they decide to stay in a cherished neighborhood.

Says Newman: “One of the things that attracted us to do a rebuild is that we could choose what the house looked like—not super modern, but we didn’t want it just to blend in and look like anything else out there.”

This article originally appeared as the March 2020 issue‘s cover story. For more real estate coverage, subscribe to our weekly Home newsletter.