It can start as soon as parents bring the newborn home from the hospital.

“You need a Social Security number,” says Joe Van Name of Advisors Financial in Vienna. “But by now they don’t let babies leave the hospital without one.”

The Social Security number is necessary to open up a 529 savings plan to finance the child’s college education, an enterprise that grows more costly by the year.

“Start early,” urges Lisa Kirchenbauer at Omega Wealth Management. “That’s my No. 1 recommendation.”

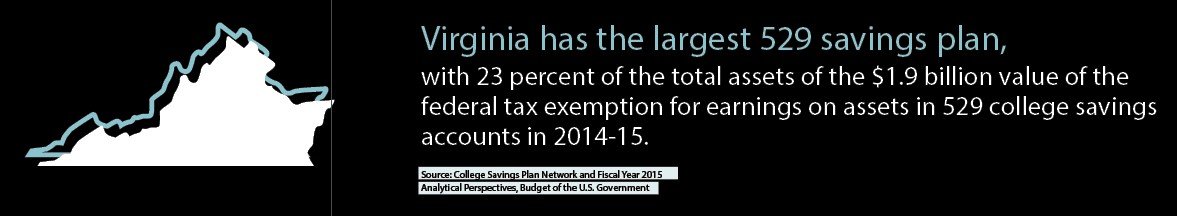

The 529 plans vary from state to state, but essentially they function like retirement savings plans, allowing individuals to compound investments tax-free. In Virginia, Maryland and the District of Columbia, contributions are deductible from state tax up to certain limits. Distributions, like the growth in the plans, are exempt from both state and federal taxes.

“The compounding effect over time is enormous,” says Rose Price at VLP Financial Advisors in Vienna.

It is literally a race against time as the costs of a college education continues to rise. The College Board calculates that average tuition and fees at a private, nonprofit, four-year college—adjusted for inflation—have tripled since 1981, rising from $10,810 in 1981-82 (in 2016 dollars) to $33,480 in 2016-17. Tuition and fees at public four-year colleges more than tripled in the same period, from $2,390 to $9,650.

It is literally a race against time as the costs of a college education continues to rise. The College Board calculates that average tuition and fees at a private, nonprofit, four-year college—adjusted for inflation—have tripled since 1981, rising from $10,810 in 1981-82 (in 2016 dollars) to $33,480 in 2016-17. Tuition and fees at public four-year colleges more than tripled in the same period, from $2,390 to $9,650.

Average household income for the middle class, by way of comparison, has risen only an inflation-adjusted 30 percent or so in the past five decades, according to data from the U.S. Census Bureau.

Adding in room and board, a worst-case scenario for a private college is about $50,000 a year, or $200,000 for a four-year degree.

As costs skyrocket, skepticism about whether college is even worth it is growing. A Wall Street Journal/NBC poll released in September found a sharp shift in sentiment, with opinion about evenly divided between those who think a four-year degree is worth it (49 percent) and those who don’t (47 percent). A similar poll in 2013 found a 13-point advantage in favor.

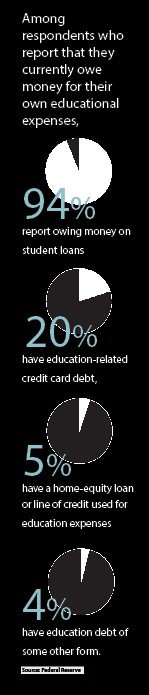

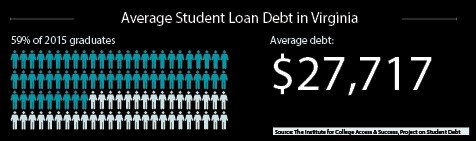

That kind of skepticism hasn’t really taken hold in this region, financial advisers say, but parents are growing more cautious and more sensitive to the need for planning. As student debt surges past the $1.3 trillion mark nationwide, the stakes are clearly rising.

“It’s such an emotionally charged issue,” says Kirchenbauer. “Everyone wants their children to be better off, to graduate without debt.”

Nonetheless, she advises, “you should manage to have some very frank conversations with your children so you can make an educated decision.” (No pun intended.)

Many parents may not be ready to open a 529 plan for a newborn or even in the first few years. Some wait until the child starts school. “Once you get rid of day care payments, you can start putting money into college savings,” suggests Price.

Others, however, do start right away, and they get the grandparents involved. “The child won’t miss one more toy,” says Kirchenbauer. “Instead of toys, have them make a contribution to the 529 plan.”

Van Name encourages his clients to help save for their grandchildren’s education, especially if their estate goes beyond the tax exemption. “Why not help your children with their cash flow now, when they need it,” he says, by contributing to the grandchildren’s college savings.

Parents have numerous expenses when starting a family and building a career, so college savings may not be the first priority. “It’s not always easy,” Kirchenbauer says. “But every little bit helps—anything you can do.”

If budgets are tight in the child’s early years, one tactic is to use bonuses and raises to start funding the savings plan. “You won’t miss the money you don’t have,” says Price. However, she acknowledges that, too, can be a challenge, as expenses can also increase, especially with the arrival of other children and the need for a bigger home.

But financial planners agree that, important as college savings are, they should not supersede saving for retirement. The mantra here is, “You can take out a loan for college, but you can’t get a loan for retirement.”

Among other things, maxing out a retirement plan at work gets the full benefit of employer-matching funds. “You want to get all the free money you can,” says Van Name.

However, there is a broad consensus among financial advisors that 529 plans are the best way to save for children’s college, and the earlier one starts, the better.

“It’s a good, long period, and you can absorb volatility in the early phase,” Van Name says. The Virginia 529 plans, managed by American Funds, are age-based, he notes, and grow more cautious as the child approaches college age. The longer time period also enhances the advantage of dollar-cost averaging, or buying in regular monthly installments regardless of share price.

There are caveats. One type of 529 is a prepaid tuition plan, which is appealing because it locks in that volatile cost. “But it only covers tuition and fees,” cautions Kirchenbauer. “It does not include room and board.”

Finding the Right Mix

Room and board costs have also increased exponentially. These are not the dorm rooms and dining halls of yore with cramped beds and one payphone in the hall, financial planners warn. Student housing these days offers veritable suites, complete with kitchens and Wi-Fi. Dining halls are more upscale, too, with dishes to satisfy the vegetarian, gluten-free or other diets of today’s students. And all this has to be paid for.

“Even if someone gets a full ride on tuition, there [is] the other half of the costs,” says Van Name. A general 529 savings plan can be used to cover room and board, as well as other costs associated with college education nowadays, such as a laptop.

Some parents will opt to have both, locking in the guaranteed tuition with one plan and saving for other costs with the other. A third component, suggests Price, can be a Roth IRA. Normally there is a 10-percent penalty for withdrawing funds before age 59-1/2, but qualified higher education expenses for the owner, children and grandchildren are exempt from the penalty. One drawback, however, is that once money is withdrawn from a retirement account, it can’t be put back, so it won’t be available for retirement.

“It’s important to get the right mix,” Price says. “Every client is different.”

Even a long-term, well-funded savings plan can fall short, though, once the child is ready to enter college. This is where the battery of scholarship and grant funds from the college, work-study and subsidized loans available through the Free Application for Federal Student Aid come in. Since even a grant or scholarship that is not needs-based usually requires FAFSA, even those families that feel their income will not qualify them for aid should go through this process.

The application process and the aid available have largely become standardized so that the same resources are available at most colleges and universities, including those in the region.

It can be harrowing, especially for the first child. “There is a lot of confusion about what their options are,” Price says of parents approaching the process for the first time. “It takes a lot of effort just to understand the process.”

It is, however, virtually indispensable. “You can get a bunch of aid,” Kirchenbauer says. But she warns there are pitfalls, for instance, for small-business owners. If they just list their assets, it may disqualify the student for aid. Submitting a profit and loss statement and other documentation to show actual income makes for a better case.

The important thing to keep in mind, she says, is that you don’t have to take no for an answer. “It can be intimidating, but in fact it is a negotiation,” she says. Pushback from the parents can result in aid, after all.

Another potential pitfall is that those distributions from the Roth IRA will count as income in next year’s FAFSA and can affect eligibility for need-based aid. Some awards are based on merit and not on need, but they still require FAFSA.

“Look for scholarship money,” Van Name counsels. “There’s a lot of money out there, and some of it never gets used.” Van Name manages a $300,000 scholarship fund, and there are some years when money is still left in the till, he says.

Scholarships that can help defray college costs are available from sources as varied as the local Kiwanis Club or a high-school booster organization. Tuition aid is also available through niche or targeted scholarships for various fields of study or types of students. Civil engineering students can get money from the American Concrete Institute, for instance, and the Future Farmers of America have scholarships for agricultural studies.

Funds are available for students with disabilities, minority students and other types of students, such as cancer survivors or those who identify as LGBT. Fastweb can help match scholarships to student profiles, and the Scholarship Coach at U.S. News and World Report also helps locate tuition aid.

Federal Pell Grants are need-based, but unlike loans, they don’t have to be repaid. The website for Christopher Newport University in Newport News lists Pell Grants but also a number of state-funded grants for Virginia residents or graduates of Virginia high schools.

Federally subsidized loans (Stafford or Perkins) are also based on need, but as tuition costs rise, more students will need them. The amount of money available to each individual is limited, however, and rising costs have outpaced funds available. Unsubsidized loans are also available but likewise only to a certain limit.

The federal program for parent loans for undergraduate students, Parent PLUS loans, have a fixed interest rate (currently 7 percent) and are not need-based so even wealthy parents can obtain them. They can go up to the full cost of attendance, depending on creditworthiness. Unlike the subsidized student loans, interest does accrue while the student is in school.

Beyond FAFSA

Private loans not subsidized by the government have become much more important as the limits on government loans fail to keep up with college costs. These will be more expensive, especially as fees in addition to higher interest rates add to the overall cost of the loan. Interest accrues even while the student is in school, though the rate may be slightly lower. And, cautions Price, “you have to read the fine print.” Prepayment terms, for instance, may be tricky.

High costs may not be dissuading families in the region from sending their kids to college, but they are not averse to saving costs where possible.

“What you do see more often is a student spending two years at NOVA [Northern Virginia Community College] and then transferring to a four-year college for the bachelor’s degree, as a cost-savings,” says Van Name.

While costs may be much lower at a community college, it isn’t free, so it’s important to look for scholarship money there as well. The Phi Theta Kappa Honor Society offers scholarships for the associate degree at the community college and will continue it for a bachelor’s degree at a four-year college. The Coca-Cola Community College Academic Team awards 150 scholarships a year in varying amounts.

Even after all this, there can be a shortfall. Extended families can help cover it. Grandparents can give up to the full gift amount (currently $14,000 a year) tax-free or even frontload a contribution and take the exemption over five years. Kirchenbauer points out that intra-family loans through Zimple Money streamline and professionalize that source of funds and also give the student a chance to build a credit history.

In fact, crowdfunding sites like Zimple are growing as sources of funds to pay for college. These new facilities provide a way for friends and family to contribute with the more formal apparatus of documentation and loan servicing. Investors, too, are interested in getting into what is now the second-largest debt market after mortgages. CommonBond and SoFi are two peer-to-peer lending sites with specific student loan programs. “These new players can be quite competitive,” says Price.

And there is still room for that old-fashioned part-time job beyond work-study. Campus jobs including resident assistant or campus tour guide are possibilities, as well as merit-based employment such as research assistant. The student has control over these earnings, unlike work-study, where wages go directly to pay off tuition.