The economy might have recovered from the depths of the Great Recession, but for many Americans, financial stress persists. In fact, an April 2016 Gallup poll showed that concern about seven different financial situations from medical costs to retirement savings increased from 2015 to 2016. And the experts aren’t immune. We asked some of this year’s Top Financial Professionals to explain what worries keep them up at night and what tips they have for navigating interest rates and saving money.

In your best interest

While next-to-nothing interest rates have been in the news this summer, they’ve been trending down since the 1980s. And even though experts are continually predicting that they will start rising again soon, nobody can say for sure. This uncertainty can make many investors uncomfortable and can make balancing risks and returns trickier, so we reached out to some of this year’s Top Financial Professionals to gather five tips for navigating the current interest environment.

1. Reassess long-term debt.

While low interest rates can frustrate those looking to invest for income, it presents an opportunity for borrowers. “We advise clients to take advantage of these low rates while they can, to consider refinancing their home if they haven’t already and manage any kind of debt instruments that they have,” says Tracey Baker, president of CJM Wealth Advisers.

2. Borrow now.

In a similar vein, low interest rates make for a great market for borrowers. “If you can get a bank to lend you money, you can borrow at interest rates you’ll never see again in your lifetime,” says David Speck, managing director-investments at Speck-Caudron Investment Group of Wells Fargo Advisors. So despite being near the end of peak homebuying season, it’s a good time to buy real estate. “I think it’s a great time to get a house, and lenders seem willing to lend to folks,” Baker says. “In this area, people have good income, and there’s no longer the issue that homes won’t appraise for what folks are paying for them.”

3. Don’t fear the stock market.

A decade or two ago, people could invest in CDs with solid 4 or 5 percent interest rates or buy a 20-year Treasury bond with a 7 percent interest rate. Today, rates for six-month, one-year and five-year CDs are all below 1 percent, and a 20-year Treasury bond will bring in about 2 percent in interest. Suffice it to say, that is no longer an attractive investment strategy, which means many people are moving toward equity investment. “I’m much more cautious about the bond market than I am about the stock market, between those two venues for investing,” Speck says.

4. Manage interest-rate risk.

Education is the best defense against market volatility. When choosing an investment, Ken Robinson, president of KCR Wealth Management, says to make sure you know how certain types of bonds are going to react to interest rate changes. “We advise clients to stick to short- and intermediate-term, high-rated corporate and government bonds for their bond portfolio in the face of fluctuating interest rates,” he says. “Long-term bonds, in many cases, are just as risky as investing in stocks; the only problem is you don’t get compensated with a high enough level of performance.”

5. Stay flexible in your long-term plan.

Financial advisers will tell you that reactionary decisions are almost never wise and that trying to predict the future will leave you frustrated, so when uncertainties arise, it’s time to trust in the plan you’ve created. “Your portfolio should wax and wane a bit so that as challenges come, you can sort of shift and tilt away from that, and as skies clear up, you can shift and tilt and participate more with that,” Angela Bender, managing partner at AMJ Financial Wealth Management, says. “It shouldn’t be so static that it looks 100 percent the same way all of the time.”

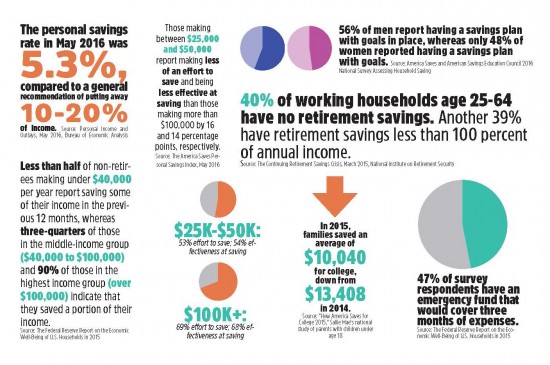

How do Americans save money?

Whether it be for retirement, higher education or unexpected emergencies, putting money away early and aggressively is universally acknowledged as a necessity. But as with most pieces of sage advice, the reality of following through is not as clear. The following research gives a little insight into how everyday people are contributing to their nest eggs and planning for the future—if they are at all.

We asked some of this year’s Top Financial Professionals to explain what financial worries keep them up at night.

“What worries me more than anything else is the 24 hours a day, seven days a week news culture that we live in, in which everything is breaking news and there’s no context or proportionality. That contributes to everyone reacting to information moment by moment. We always talk in our office that our greatest responsibility is to help our clients separate signals from noise. There’s a lot of noise. If you’re well-balanced and well-managed in your investments, you’ll be fine.” —David Speck, managing director-investments at Speck-Caudron Investment Group of Wells Fargo Advisors

“The amount of financial illiteracy that I see. People don’t even know it’s a problem. The financial world is a very complex world; I would definitely say most of investing is fairly counterintuitive, and too often we rely on old wisdom that we’ve heard. The economy has changed, and axioms that were true 20 or 30 years ago just aren’t true today.” —Angela Bender, managing partner at AMJ Financial Wealth Management

“Our practice is pretty diversified, and I sit mainly on the investment side of it, so when I think about [financial worries], I’m thinking from an investment perspective. If an investment keeps me or my client up at night, we should get rid of it! We’re trying to make money the old-fashioned way: grow it over time in a relatively conservative manner.” —Eric Wightman, managing director at The Wise Investor Group

“What keeps me up at night is worrying about what’s going on around the world. There are so many issues and problems around the world, especially outside the U.S.: things like the Brexit, China slowing down, rates hitting all-time record lows and what do we do with fixed income. There are just a number of issues here that we’re worrying about for our clients that all seem to work out over time, but there are certainly issues that pop up here and there and make the market more volatile.” —Dana Sippel, financial adviser at West Financial Services Inc.

“As an adviser, I worry about people outspending their money. That would be my biggest concern: folks that are spending significantly more than they can afford. In this area, there are so many people who have such a significant portion of their net worth tied up in their home, and they don’t want to be faced with selling their home in order to provide the liquidity needed to provide cash flow for their lifestyle. Our worst fear is that someone runs out of money.” —Tracey A. Baker, president at CJM Wealth Advisers

“I would say the impact the 24/7 news cycle has on my clients. What keeps me up at night is worrying about the impact that the media culture has on our clients’ discipline when it comes to not reacting emotionally to the inevitable scary events that occur from time to time. From our perspective as an advisory firm, one of our most important jobs is to educate our clients and to do so on an ongoing basis. We want them to understand how their financial plans work and the principles they’re based on, and we also want them to feel at ease and to maintain discipline.” —Ken Robinson, president of KCR Wealth Management

“What keeps me up at night is worrying about whether or not I’ve asked my clients every question that would take us through any scenario to best plan for their future. We can’t control what the markets are going to do; what we can control is making sure we’re saving and making sure we’re diversified and making sure we’re controlling cost and addressing the plan for where we want to be that’s flexible enough that we can adapt as we need to over time.” —Laurie Belew, senior financial adviser at FJY Financial